Although most of my recent efforts have been around helping entrepreneurs, it has become apparent that investors often need help evaluating potential product and business investments. The large Venture Capital firms have analysts and product and marketing experts on staff. The smaller VCs and Angels don’t always have access to those resources.

That led to a recent engagement with a local investment company, missing a week of blogging, and this post!

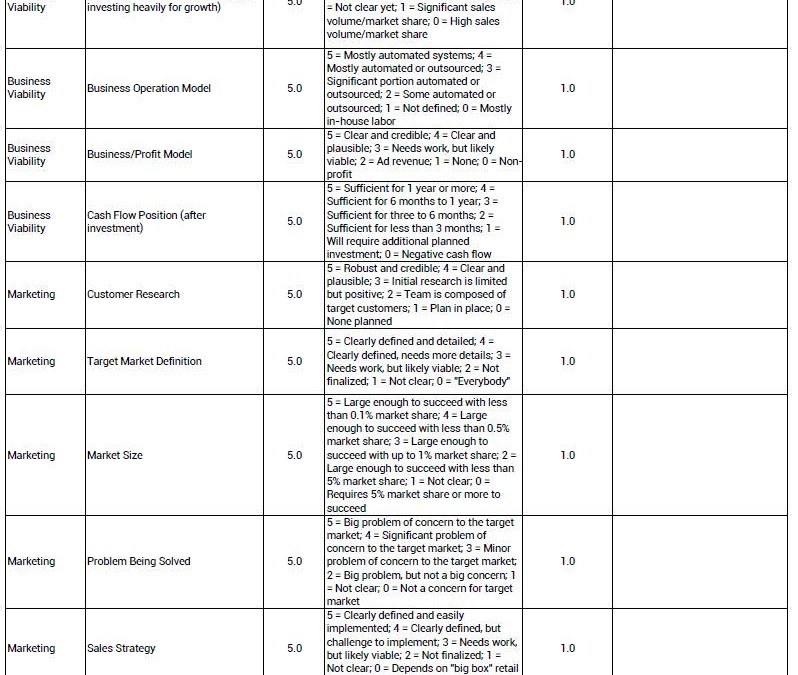

Of course, every investor has their own preferences and will apply more weight to one area or another. So I created a simple, spreadsheet “scorecard” investors can use to quickly sort and rate the various opportunities that cross their desks to help decide which ones may be worthy of more due diligence leading to a possible investment.

The intention was to try to quantify some of the areas that significantly impact the potential risks and reward, and permit the investor to easily provide more “weight” or importance to some factors over others. The areas covered include various aspects of the Team’s Experience, the Product type and development status, the potential Business Viability in terms of actually generating profit and revenue (I know that is not so popular in the press these days, and many “valuations” have nothing to do with revenue or profit, but smaller firms prefer hard valuations), the Marketing plan, IP if any, and key characteristics of the Investment opportunity itself.

The image above is of a perfect score (which likely will not occur in reality), with all items having an equal rating. Would appreciate any feedback you may have. Click here to download the scorecard in excel (no opt in required).